sales tax in orange county california

1496 rows 2022 List of California Local Sales Tax Rates. The State of California opened the application period for the California Property Tax Postponement Program PTP.

Penny Sales Tax To Appear On Orange County Ballot In November

The statewide tax rate is 725.

. There is no applicable city tax. Download all California sales tax rates by zip code. Internet Property Tax Auction.

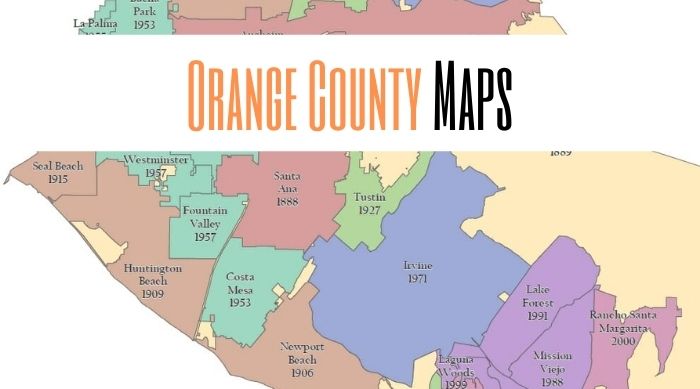

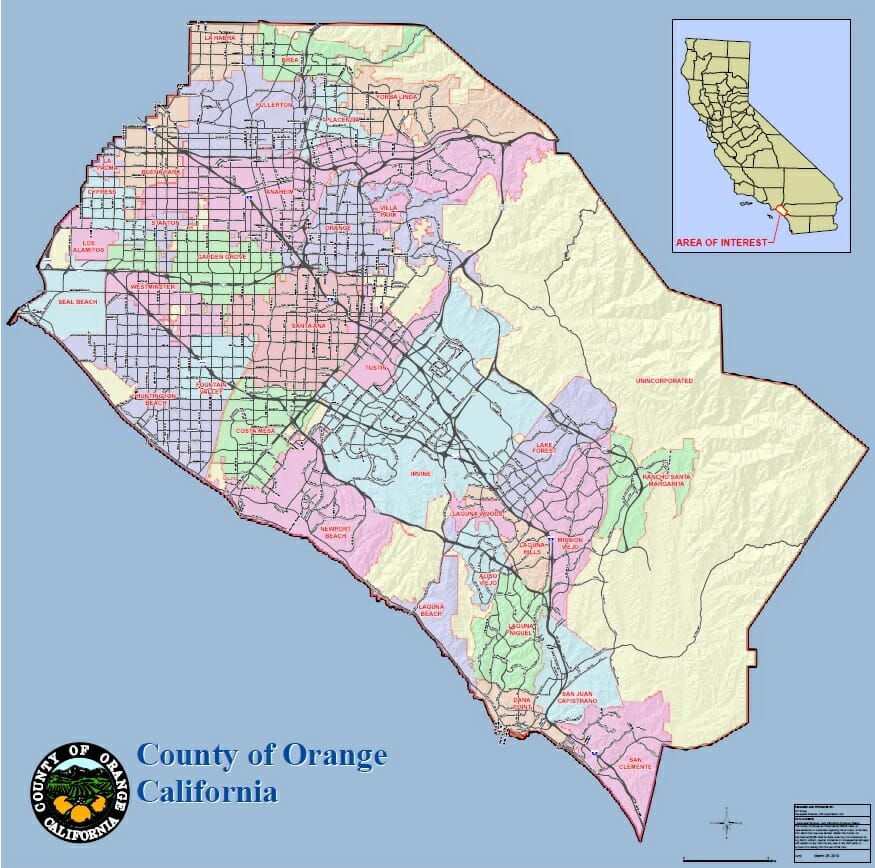

This is the total of state and county sales tax rates. County of Orange. Average Sales Tax With Local.

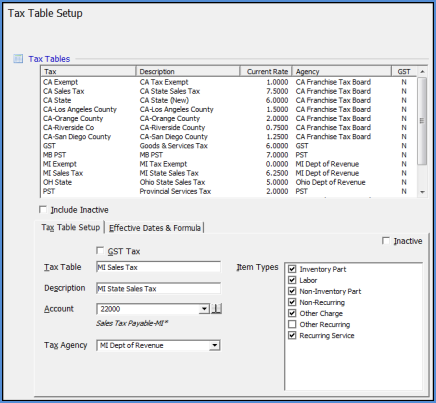

This is the figure consisting of state and municipal taxes of which 6 of the Sales Tax. This rate includes any state county city and local sales taxes. California has a 6 sales tax and Orange County collects an.

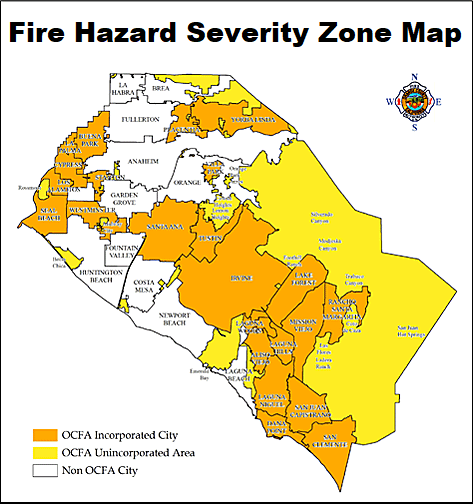

Businesses impacted by recent California fires may qualify for extensions tax relief and more. The average cumulative sales tax rate in Orange County California is 823 with a range that spans from 775 to 1025. The special district tax is an additional percentage that is used to fund specific.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Lowest sales tax NA Highest sales tax 1075 California Sales Tax. For in person tax sales payment must be made in cash US currency only limited to 10000 or a state or federally chartered bank-issued cashiers check made payable to the County of.

This office is also responsible for the sale of property subject to the. The 775 sales tax rate in Orange consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. What is the sales tax rate in Orange County.

You can print a 775. The state sales tax is 6 while the county and city rates vary depending on the location. The California sales tax rate is currently.

The December 2020 total local sales tax rate was also 7750. The Office of the Tax Collector is responsible for collecting taxes on all secured and unsecured property in Orange County. The current total local sales tax rate in Orange County CA is 7750.

Box 1438 Santa Ana CA 92702-1438. The minimum combined sales tax rate is 775 for the year 2022 in Orange County. The Orange County California sales tax is 775 consisting of 600 California state sales tax and 175 Orange County local sales.

The total sales tax rate in any given location can be broken down into state county city and special district rates. California has 2558 cities counties and special districts that collect a local sales tax in addition to the California state sales taxClick any locality for a full breakdown of local property taxes. The latest sales tax rate for Orange CA.

1788 rows Businesses impacted by recent California fires may qualify for. The minimum combined 2022 sales tax rate for Orange California is. Method to calculate Orange County sales tax in 2021.

The average cumulative sales tax rate in Orange County California is 823 with a range that spans from 775 to 1025. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Orange County California is.

Those district tax rates range from 010 to. Please visit our State of Emergency Tax Relief page for additional information. 2020 rates included for use while preparing your income tax deduction.

This program allows low income. This includes the rates on the state county city and special. Currency only paid in person at the Office of the Treasurer-Tax.

Quickbooks Helps Ecommerce Businesses Calculate Sales Tax

Understanding California S Property Taxes

California Sales Tax Rates By City County 2022

Shopify Calculating California Sales Tax Incorrectly Shopify Community

State By State Guide To Economic Nexus Laws

Oc Treasurer Tax Collector Oc Treasurer Tax Collector

Oc Treasurer Tax Collector Oc Treasurer Tax Collector

Orange County Property Tax Oc Tax Collector Tax Specialists

What You Need To Know About California Sales Tax Smartasset

Civil Criminal Tax Attorney Orange County Taylor Law In Santa Ana

Historical California Tax Policy Information Ballotpedia

Food And Sales Tax 2020 In California Heather

Santa Ana Puts Sales Tax Increase On November Ballot Would Be Highest In Oc

18 Southern California Cities Will Ask To Raise Sales Tax On November Ballot Orange County Register

Most Sales Tax And Bond Measures In Orange County Cities And Schools Are Passing Orange County Register